Growth, trends, Covid-19 impact, and forecasts for the telemedicine market (2023 – 2028)

The telemedicine market was estimated to be worth USD 104437.92 million in 2021 and is anticipated to generate USD 272756.3 million in revenue in 2027, registering a CAGR of 20.5% over the forecast period of 2022-2027.

During the COVID-19 pandemic, telehealth has become a crucial aspect of healthcare. Physical segregation was implemented to reduce the transmission of the coronavirus sickness during the SARS-CoV-2 pandemic, according to a research article published in 2020 in the JCO Global Oncology-An American Society of Clinical Oncology Journal. As a result, telemedicine is now used for most outpatient oncology appointments.

Even though most healthcare systems had telemedicine services in place before the pandemic started, usage didn’t pick up until the COVID-19 crisis. This is large because there were fewer in-person encounters and travel restrictions during the COVID-19 crisis, encouraging clinicians to adapt telemedicine-based consultations even more during the pandemic.

Thus, it is anticipated that the COVID-19 pandemic will significantly favorably affect the expansion of the telemedicine market internationally.

Rising healthcare expenses, technical advancements, increased remote patient monitoring, and the burden of chronic diseases are the main drivers of telemedicine market growth.

Globally, healthcare expenses are rising. Increased use of healthcare services is the main cause of rising healthcare expenditures, increasing consumer demand for novel and cutting-edge methods, lifestyle choices, etc.

Moreover, it might be ascribed to the cost-shifting of public initiatives to private actors. Poor reimbursement rates have made it more difficult for hospitals and physicians to shift costs to private payers, who in turn demand significantly higher prices for the same services, impacting health insurance rates.

According to National Health Spending Projections 2018–2027, national health spending in the US is predicted to increase by an average of 5.5% year from 2018–2027 and reach around USD 6.0 trillion by that year.

Telehealth technologies have proven to improve health outcomes and cut expenses. Telemedicine saves money for patients, providers, and payers compared to conventional methods.

Through better chronic illness management, shorter travel times, pooled health professional staffing, and fewer and shorter hospital stays. Telemedicine has been lowering healthcare costs while enhancing efficiency. As a result of all the aforementioned factors, the market is anticipated to snowball over the next years.

Telehomes are anticipated to experience the fastest growth throughout the forecast period in the telemedicine market.

The increase in chronic diseases is a global issue that burdens the healthcare system. Using the most recent telecommunications technology, tele-homecare is a creative approach to offering care, monitoring a patient, and delivering information. Monitoring makes it possible to detect diseases early and stop chronic disorders.

Tele-homecare has been one of the finest ways for patients to receive medical guidance during the COVID-19 pandemic in the convenience of their own homes.

In 2020, improvement in medication adherence among teenage transplant recipients was noted while actively participating in the home-based telehealth video conference during the COVID-19 pandemic, according to a study article published in JMIR Pediatrics and Parents. So, it is anticipated that the COVID-19 pandemic will accelerate the segment’s growth.

The whole system demonstrator (WSD) project in the UK, the veterans’ health segmentation (VHA) project in the US, and the TELEKART initiative in Denmark are just a few of the nations that have started tele-homecare programs.

These tele-homecare solutions manage, reduce, and prevent chronic diseases with patient monitoring from a distance.

Universities are working together to advance tele-homecare. For instance, the University of Ottawa Heart Center has been making good progress in telehome monitoring technology by providing services for various regions under the regional home monitoring program for cardiac patients.

Telehome services allow patients and hospitals to save a lot of money. As a result, the telemedicine market is directly impacted by the growing usage of tele-homecare services.

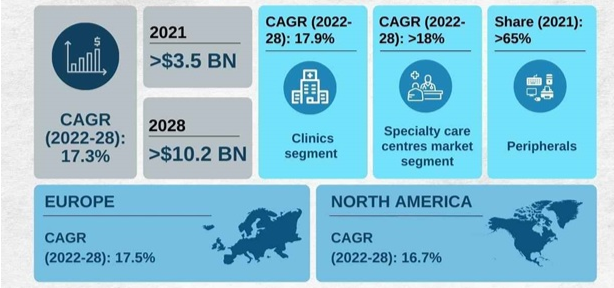

North America held the largest market share for telemedicine and is anticipated to rule the industry over the forecast period.

Because of the rising prevalence of chronic diseases and the widespread use of cutting-edge medical technologies, telemedicine is a fast-expanding area of healthcare in the US. The use of telemedicine has led to better care coordination, higher patient satisfaction, and lower healthcare costs.

Throughout the projection period, the market is anticipated to rise due to patient adoption of home care, rising demand for mobile technology, and declining hospital visits. With the rise of telemedicine applications that assist the populace in taking an active role in managing their personal health, particularly during the current COVID-19 pandemic, healthcare in the US is witnessing favorable trends.

Mobile technology and smartphones make it possible to apply lifestyle and clinical applications to support, promote, and adopt healthy behaviors.

The government’s actions are also anticipated to stimulate the market. For instance, the Centers for Medicare & Medicaid Services (CMS) has increased the number of Medicare members who can use telehealth services, allowing them to access a wider range of services from healthcare professionals without visiting healthcare facilities physically.

Starting on March 6, 2020, Medicare will also cover hospital, office, and other visits provided via telehealth across the nation, including in patients’ residences. This will benefit the market under investigation.

To remain competitive, vendors offer new products and engage in partnerships, collaborations, acquisitions, mergers, and product launches. For instance, Morneau Shepell unveiled its first integrated telemedicine solution in the US in November 2020. Employees in the region will have access to digital healthcare support through this service for all of their urgent and important well-being requirements.

Moreover, AMD Global Telemedicine Inc. and iTelemed, an organization based in Ontario that offers virtual healthcare solutions, teamed together in August 2020 to address the underserved healthcare requirements of Canada’s disenfranchised populations during the COVID-19 pandemic. The telemedicine market is a Competitive analysis of the telemedicine industry

A small number of significant market players has resulted in moderate market consolidation. In contrast, mid-size to smaller businesses are expanding their market presence by releasing new items at reduced prices due to technological improvements and product breakthroughs.

Market share leaders in the telemedicine sector include Allscripts Healthcare Solutions Inc., BioTelemetry, Medtronic, and Koninklijke Philips NV. over the anticipated time frame.

The big players collaborate in many strategic alliances to broaden their product lines. For instance, Teladoc Health signed a deal to buy InTouch Health in January 2020 to expand its reach into hospitals and healthcare systems and strengthen its telemedicine offerings.